BizLibrary Is Where

Learning Happens

Compliance Happens

Upskilling Happens

Leadership Happens

Engagement Happens

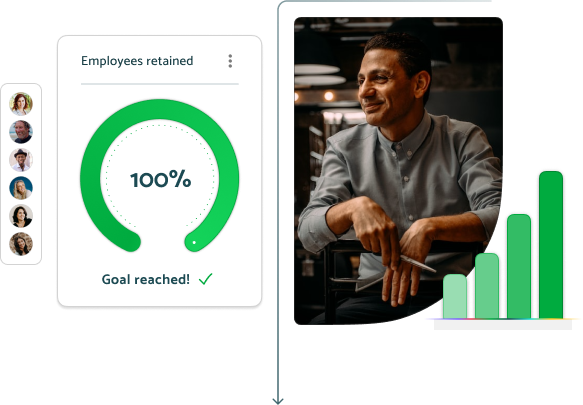

Retention Happens

Experience the all-in-one L&D solution for

employee retention & development

employee retention & development

Learning Solutions For

Compliance & Culture

Drive mandatory training completion while boosting employee engagement and connection to your culture

Upskilling & Reskilling

Retain and motivate learners by putting them in the driver's seat of their own development

Management & Leadership

Create a leadership foundation that helps career path your talent while fueling company growth

Content That Inspires

Your Employees

Soft Skills

Expert Led

HR Compliance

Leadership

Information Technology

Sales & Service

Workplace Safety

Business Skills

Leadership

More Ways We Can Support Your

Training & Development Programs

Award-winning

Learning Solutions

Onboarding

Onboarding  Employee Wellness

Employee Wellness  Remote & Hybrid Work

Remote & Hybrid Work  Communication

Communication